How China’s E-Commerce Landscape Will Change in 2022

For China’s internet ecosystem, one of the defining trends of 2021 was the fragmentation of the platform economy. Incumbent technology giants saw some of their business moats filled in due to a combination of market forces, innovation, changing consumer habits, and the government’s rollout of a tougher antitrust regime. Across several sub-sectors, newer entrants captured more eyeballs and market share.

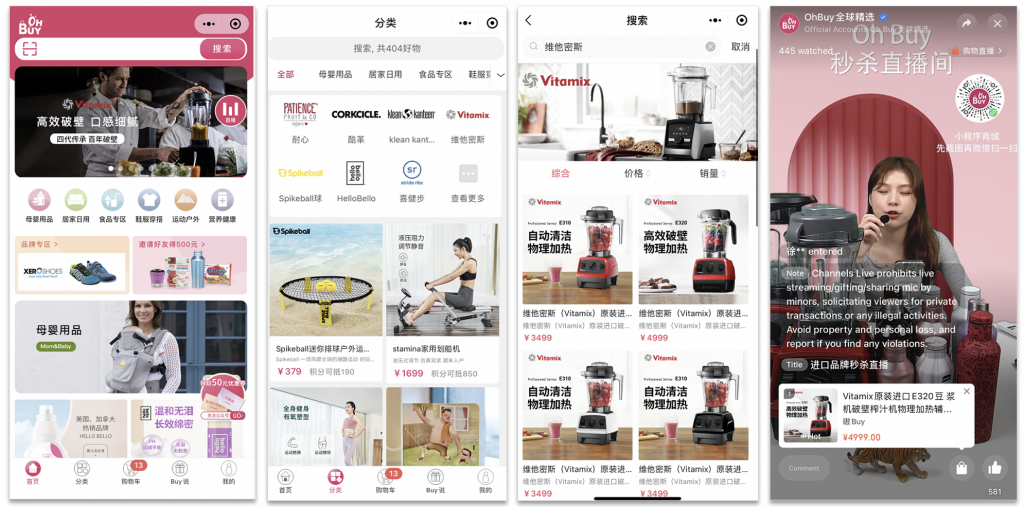

In the e-commerce industry specifically, new challengers took aim at Alibaba’s throne, with social platforms such as Douyin, Kuaishou, WeChat, and Xiaohongshu seeing rapid growth as channels for e-commerce.

By the end of 2021, the theme of “fragmentation” could even be extended to livestreaming, an increasingly important sector within the broader e-commerce industry. The livestreaming market in China has been highly concentrated, with star hosts wielding tremendous bargaining power over both platforms and merchants—but the recent crackdown on three top livestreamers has shaken up the industry.

How will all these seismic changes to China e-commerce ripple out across the Year of the Tiger? Read on to see our predictions.

Social Commerce Platforms Will Take a Larger Share of the E-Commerce Pie

The 2021 growth figures for social commerce were jaw-dropping—and in 2022 we expect this growth to accelerate further.

Although ByteDance does not disclose its e-commerce revenue, inside sources at the end of 2021 said that the company was aiming to exceed $150 billion USD in gross merchandise value (GMV) on Douyin for the year—a six-fold increase from 2020. For Douyin’s main short video competitor, Kuaishou, e-commerce GMV jumped 86.1% year-over-year, according to the firm’s latest financial results from Q3 2021. Meanwhile, transaction volume on WeChat’s mini programs, which encompasses both retail and digital services, is up 897% since 2019—with the number of overseas brands selling on mini programs up 268% in that time.

In comparison, Alibaba noted in its Q3 2021 financial results that the GMV of physical goods for the quarter had grown by single-digits year-over-year, in part due to “more players in the China e-commerce market”.

Despite the hype, these disparate growth stories have not caused a significant shakeup in the overall distribution of the e-commerce pie.

Alibaba is still the giant in the market, with a 58% share in retail e-commerce in 2021—down only slightly from 60% in 2020. The firm still has huge competitive advantages with the largest e-commerce user base, strong trust from users and merchants, the most popular livestreaming platform, as well as a robust logistics network. For foreign brands entering the China market, setting up a Tmall store is still the most important move for establishing a China e-commerce presence.

JD.com, the second largest player, has a 27% market share.

While the upstart platforms have surging GMV figures, they started from scratch and have only eked out single-digit market shares.

But these new entrants to e-commerce are poised to post major growth figures again in 2022—so this year we may see them take a larger share of the pie.

Key to the success of Douyin, Kuaishou, WeChat, and Xiaohongshu is that they are fundamentally social platforms that attract hundreds of millions of regular users for reasons other than just to shop. The newly developed e-commerce functions on these platforms offer users the option of making spontaneous, friction-less purchases without changing apps. Tencent-backed JD.com and Pinduoduo also benefit from this trend because they integrate with WeChat.

With the convenience and entertainment value offered by this new mode of online shopping, more and more Chinese consumers aren’t necessarily carrying out targeted product searches on traditional e-commerce marketplaces when they buy goods. Rather, they are making more spontaneous purchases as they browse content or chat with friends online.

For example, a young Chinese office worker watching short videos on Douyin for entertainment is exposed to advertisements and digital stores that are seamlessly integrated into the video feed—or are woven into user-generated videos themselves. That viewer can then purchase products immediately within the app.

As these newer e-commerce platforms mature and offer new, innovative, friction-less, and—most importantly—entertaining solutions to purchase products, their overall GMV will grow, as will their respective share of online commerce in China.

Alibaba has shown its ability to be creative and innovative to navigate challenges in the past—and it will likely do so again to capture the growth opportunities presented by the rise of social commerce.

The Garden Walls Will be Chipped Away

The fragmentation of the e-commerce landscape has been further fuelled by the recent anti-trust wave in China—and that will continue in 2022.

Over the past 14 months, regulators in China have shown their commitment to anti-trust to ensure that no one platform becomes too powerful over consumers and merchants. As a result, we expect China’s “walled gardens” to be significantly dismantled over the course of the next year as additional regulations are rolled out and platform companies are forced to comply.

The anti-trust push will lead to a better experience for consumers and merchants, and will also oxygenate the competitive environment, which will allow for upstart online platforms to continue to emerge and grow.

With the IPO of JD Logistics that took place in June 2021, the ability to launch a brand-new social commerce platform with back-end support provided by one of the big Chinese logistics companies has never been easier.

These two factors will combine to allow for existing social commerce platforms to see continued growth over the next year and even possibly the emergence of one or more new social commerce platforms.

The rise of social commerce offers new opportunities for foreign brands to connect with and sell to Chinese consumers. While many foreign brands leverage these social platforms for brand development, they have generally not capitalized on these channels for sales – until now. According to ByteDance, 80 percent of brands that sold more than RMB 100 million were domestic brands.

In 2022 we expect more foreign brands to set up e-stores on these platforms directly to capture this new consumer trend.

Spreading the Livestreaming Wealth

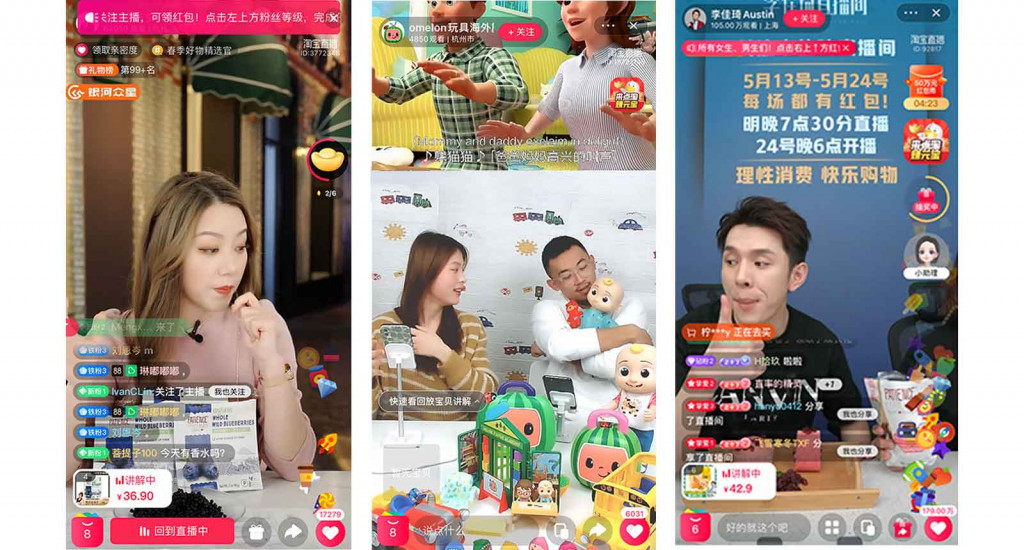

Livestreaming has cemented itself as a crucial sales and marketing channel in China, accounting for roughly 15% of all e-commerce GMV in 2021. Livestreaming has grown consistently in the last five years, and we predict that it will again contribute to an even larger share of online sales in China in 2022.

However, due to heightened regulatory scrutiny and market forces, the livestreaming sector is undergoing a major shakeup.

In November and December, three of China’s top livestreamers—Viya, the “Livestream Queen”, as well as Zhu Chenhui (Cherie) and Lin Shanshan—were given hefty fines for tax evasion and removed from livestreaming platforms indefinitely.

Like the broader Chinese e-commerce industry, the livestreaming market has been highly concentrated to date. On the first day of the 2021 11.11 Singles’ Day shopping festival alone, the top two livestreamers, Viya and Austin Li, combined for $3 billion USD of sales.

The top livestreamers in China move so much product because they command massive followings. Millions of viewers tune into their shows—and have high trust for the hosts—to purchase the advertised products within the livestream broadcast.

Because the top celebrity livestreamers can help a brand reach millions of viewers, they have the leverage to charge sky-high advertising prices—Viya could charge 20% commission on all direct sales, for example—and insist that merchants offer exclusive discounts for their viewers.

This created a perpetual cycle. With the star livestreamers offering the best discounts, their followings have grown larger, further increasing their bargaining power with merchants.

With the recent regulatory pressure on star livestreamers, as well as their unfavourable fee structures, we anticipate that brands will shift their marketing budgets to work more with micro-influencers (key opinion consumers, or KOCs) and self-produced livestreams in 2022. The concentration of the livestreaming industry will start to reduce.

E-Commerce Consumption Will Grow Even Bigger

Fortunately for the leading e-commerce platform companies, they are competing over a growing pie.

In a continuation of trends from 2021, we predict that overall consumption will continue to grow in China in 2022—and that e-commerce will eat up an even larger share of that consumption.

Sales of consumer goods in 2021 were up 12.5 percent year-on-year according to China’s National Bureau of Statistics. China still represents some of the highest growth in world—and the ongoing expansion of China’s middle class is a solid foundation for consumption growth going forward.

For e-commerce specifically, the growth story is even more encouraging. According to a report from Bain and Kantar, e-commerce value grew 24% in the first three quarters of 2021. Additionally, for the first time ever, online channels accounted for over half of all Chinese retail sales in 2021.

While COVID restrictions greatly accelerated the transition to e-commerce at the outset of 2020, it appears that consumers have permanently embraced the conveniences of e-commerce. In 2021, the majority of consumers in China were not subjected to meaningful mobility restrictions—or exposed to risk of COVID-19 infection—such that they would be “forced” to shop online rather than visiting a brick-and-mortar outlet. Simply put, e-commerce is part of the new normal in China.

The Olympics Bump

While shopping increasingly happens online in China, certain offline activities are surging in popularity, especially snow and ice sports.

One promising sector to watch in 2022 is sports equipment and sports apparel, to which the Beijing 2022 Olympics is poised to give a huge boost. A revolution in the winter sports industry has been underway since Beijing was awarded the games in 2015, with the government encouraging people to participate in winter sports activities or travel to winter tourism destinations—and people doing so for the first time need equipment and apparel.

A related trend we are seeing is the rise of winter-wear as fashion, with young consumers increasingly willing to dish out on stylish winter outwear. The buzz around the Olympics will further fuel these trends.

Conclusion

Fragmentation has created uncertainty in China’s e-commerce landscape, both in terms of inter-platform competition and livestreaming.

One thing is crystal clear, however: the sector will continue to see huge growth, as China’s expanding middle class increasingly chooses to shop online.